Empowering Grid Stability: Exploring Germany’s SRL / aFRR - an Ancillary Services Frontier

-

Discover the fundamentals of Frequency Ancillary Services in Germany's electrical power system.

-

Learn how Transmission System Operators (TSOs) use control reserves, like the automatic Frequency Restoration Reserve (aFRR), to maintain grid stability.

-

Explore the intricacies of aFRR capacity and energy markets, regulatory requirements, and the impact of initiatives like the PICASSO reform.

-

Uncover how Battery Energy Storage Systems (BESS) are able to enter and profit from these markets, unlocking new revenue streams while contributing to a more sustainable and resilient energy system

Introduction to Frequency Ancillary Services in Germany

Electrical Power System - Fundamentals

In an electrical power system, it’s crucial to maintain a balance between generation and demand continuously. To achieve this, transmission system operators (TSOs) divide responsibilities into smaller balancing groups, each ensuring balance in generation, consumption, and traded energy. Furthermore, a balancing group is required to submit to the TSO a 15-minute resolution forecast of all activities for the next day.

Forecasts are essential in energy management, but they cannot be 100% accurate. Then the question arises, how does the system deal with deviations from the forecast? What mechanisms are in place to enable the TSOs to regulate this energy flow? Let us delve deeper to figure this out.

Control Reserve Mechanism

TSOs play a pivotal role in ensuring power grid stability by procuring control reserves, also known as balancing power. These reserves are crucial for managing unexpected scenarios like power plant failures, demand fluctuations, or errors in energy forecasts, thereby safeguarding the grid's stability and reliability. The primary objective of activating control reserves is to maintain the system frequency around the standard 50 Hertz mark. To achieve this, different types of control reserves are dynamically and sequentially coordinated.

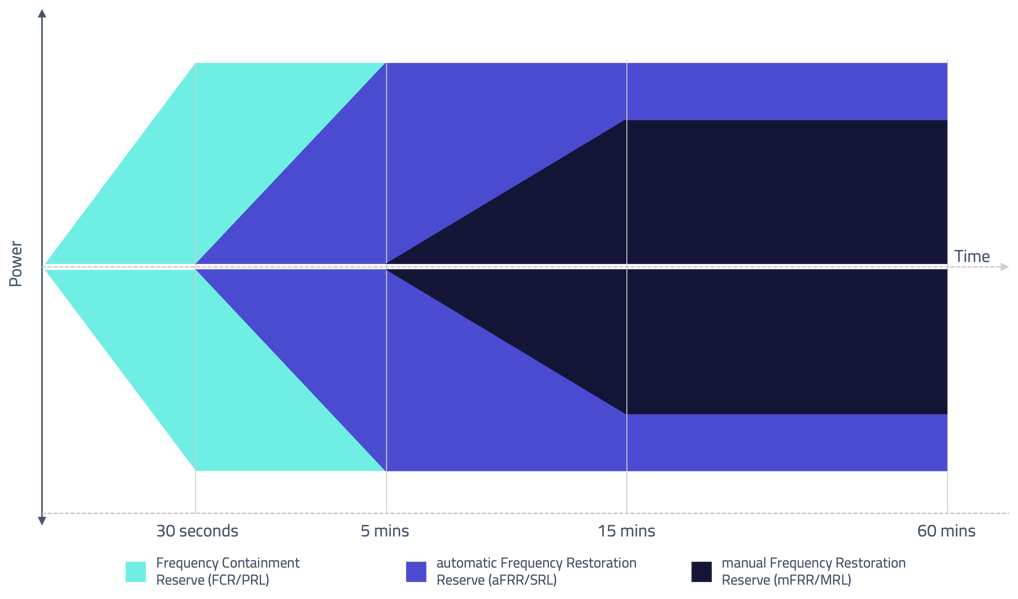

Under the guidelines established by ENTSO-E (European Network of Transmission System Operators for Electricity), German TSOs follow specific operational timelines that mirror various levels of emergency response readiness.

- Frequency Containment Reserve (FCR): must be engaged within a rapid 30-second window, acting akin to an immediate emergency measure

- automatic Frequency Restoration Reserve (aFRR): follows suit to restore the frequency to its nominal value, needing activation within 5 minutes similar to a swift and automated emergency reaction

- manual Frequency Restoration Reserve (mFRR): comes into play within 15 minutes, reflecting a more measured and controlled response to balance any discrepancies triggered by an event

Different power generation units exhibit varied capabilities in providing control reserve services. For instance, thermal power plants often face challenges with rapid activation, whereas stationary Battery Energy Storage Systems (BESS) may find prolonged service provision economically unfeasible. This diversity underscores the need for a balanced mix of resources to effectively cater to the diverse requirements of control reserve services.

Recent regulatory changes, spurred by initiatives like Project PICASSO in Europe, have significantly altered the landscape of aFRR, or secondary reserve. Previously, regulatory constraints limited the participation of storage systems. However, the regional overhaul of secondary reserve standards has resulted in more storage-friendly market regulations in several European countries. This regulatory evolution makes aFRR an increasingly important area for BESS. It opens avenues for market players to actively engage and leverage the growing opportunities in offering frequency restoration services.

Diving into automatic Frequency Restoration Reserve (aFRR)

TSOs utilize aFRR to maintain grid frequency within a specific range, typically +/- 0.2 Hz. This precise control is essential for preventing fluctuations that could lead to brownouts or blackouts.

A brownout is a temporary drop in voltage in an electrical power supply system, leading to the dimming of lights or a reduction in the overall power available. It's often caused intentionally by grid operators during periods of high demand to prevent a complete blackout. During a brownout, electrical devices might not function optimally due to the reduced voltage, but the power isn't entirely shut off. Whereas a blackout is the total crash of the power grid.

First, let’s dissect the entire terminology apart to better understand the encompassing terms and what they mean in terms of the power grid.

- automatic: This refers to the automated or rapid response mechanism employed by the reserve. It implies that the activation or adjustment of this reserve is triggered automatically by TSOs without manual intervention in response to grid frequency deviations.

- Frequency Restoration: Denotes the primary purpose of this reserve, which is to restore or bring back the grid frequency to its nominal value (e.g., 50 Hz or 60 Hz) in case of deviations caused by sudden imbalances between power supply and demand.

- Reserve: It signifies an available capacity or set of resources ready to be activated swiftly to counteract frequency deviations. These reserves help maintain grid stability by balancing the instantaneous mismatches between power generation and consumption.

aFRR Capacity and Energy Market - Auction Mechanism

The aFRR Capacity and Energy Market operates through an auction mechanism overseen by TSOs. Unlike FCR, aFRR bidding is bi-directional. This means participants can bid to provide either upward or downward regulation. The aFRR system comprises two distinct markets: the capacity (power) market and the energy market. While both operate on auction principles, their operations and structures significantly differ.

Capacity Market

The primary function of the Capacity Market is to ensure sufficient resources are available for potential aFRR demands. Participation in this market requires an obligation to also engage in the Energy Market, with a commitment of at least equivalent power. Bidders in the Capacity Market are compensated for the power they agree to reserve. Although the price bid in the Energy Market influences activation, in a theoretical scenario where a participant is the sole bidder in the Capacity Market, they would be activated for aFRR service regardless of their Energy Market bid, if needed.

The market is segmented into six EFA (Electricity Forward Agreement) blocks per day, each lasting four hours, with gate closure at 09:00 am CET/CEST on the day before delivery. EFA relates to load profiles in electricity market trading.

Energy Market

Here, the focus is on the actual provision of aFRR services, where participants are paid for the energy they deliver. The delivery day is divided into 15-minute delivery periods, with bids being adjustable up until 25 minutes before each period begins. Once the gate closes, the merit order list for each period is set and cannot be altered. This list is used in the auction process that occurs every four seconds, with the clearing price fluctuating based on the aFRR demand needs as determined by the TSOs.

A conceptual way to think about it is as follows: The market mechanism allows the parties to determine, up to a 15-minute resolution, their opportunity cost for getting activated. Then, depending on the demand needs of aFRR, each market participant gets compensated in a pay-as-clear bidding scheme. The animation below depicts how the clearing price changes for aFRR negative in one specific delivery period of 15 minutes.

And the following animation depicts the concept of clearing the auction for each 4 second interval and how the change in demand causes a change in the clearing price and a change in the market participants that get activated.

For those interested in details on the aFRR optimisation problem, its description has been published in [6].

Regulatory Requirements for aFRR Market

The following Table offers a summary of essential product attributes highlighting the primary distinctions among the aFRR capacity and energy markets.

| aFRR Capacity Market | aFRR Energy Market | |

|---|---|---|

| Gate Opening Time (CET) | 10 am, D-7 | 12 am, D-1 |

| Gate-Closure-Time (CET) | 9 am, D-1 | 25 minutes before the delivery period |

| Product Length | 4 hours | 15 mins |

| Minimum Bid Size | 1 MW | 1 MW |

| Bid Increment | 1 MW | 1 MW |

| Clearing mechanism | Pay-as-bid | Pay-as-cleared |

| Clearing frequency | Once per day | Every 4s |

Minimum Energy Requirements Constraints: BESS Case

To comprehensively understand the regulatory requirements for the aFRR Market, it's crucial to delve into the specific constraints faced by Reserve Providing Units (RPUs), particularly those with limited energy storage like Battery Energy Storage Systems. Understanding the aFRR market's regulatory requirements necessitates examining the specific constraints that Reserve Providing Units (RPUs), especially BESS with limited storage capacity, encounter.

For BESS, maintaining a continuous commitment to control reserve provision is challenging. Longer product lengths complicate the management of the battery's State of Charge (SoC) within an optimal range for service provision.

The recent PICASSO reform has introduced significant regulatory adjustments, notably reducing the aFRR energy market duration from four hours to fifteen minutes. We will delve deeper into these critical regulatory changes in the following section.

To put it precisely, in the context of determining the minimum energy capacity aFRR:

- When participating in both Capacity and Energy Markets: 60 minute energy buffer needs to be reserved on both ends of the SoC spectrum.

- For RPUs bidding only in the Energy Market: A 15-minute energy buffer is required at both ends of the SoC spectrum.

💡 As discussed above, it is important to note that when bidding into the Capacity Market, one has to also place bids in the Energy Market, whereas, placing bids only in Energy Market is possible!

Use Case for BESS: Reformation into PICASSO

PICASSO, which stands for Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation, aims primarily to facilitate the exchange of automatic activation of power reserves among TSOs to restore system frequency to its nominal level. Currently, 26 TSOs from 23 countries have joined the project in this collaborative effort.

The establishment of a unified platform provides standardisation of national aFRR products, with the following key objectives:

- Cost Efficiency: Reduce balancing costs by applying an optimization-based approach for aFRR activation.

- Resource Accessibility: Increase the availability of balancing energy for each TSO, enhancing both supply security and the integration of renewable energies.

- Cross-border Efficiency: Improve the use of cross-border interconnectors, especially after intra-day market operations.

To Wrap It Up

This investigation delves into the intricacies of the aFRR market, from its auction mechanisms to the specific regulatory requirements and constraints that govern it. We also focus on how the recent PICASSO Project reformed the participation of BESS in this market, enabling better grid stabilisation and integration of renewable energy resources. The regulatory reforms at the pan-European level, as driven by these developments, are not only reducing the costs associated with balancing the power grid but are also marking a significant stride towards a more sustainable and resilient energy system.

aFRR as part of the dynamic BESS value stack

We hope you enjoyed the white paper and we were able to answer many questions on the aFRR/ SRL market. In order to optimize your revenue stack it is of high importance to combine the various energy markets every day anew with a multimarket-optimization. If you want to learn more about it - get in touch via sales@entrixenergy.com.

Dont't want to miss the next Entrix knowledge piece? Subscribe to our newsletter below and stay on top of the energy market & battery optimisation.

References

-

Merten, M. (2020). Participation of battery storage systems in the automatic frequency restoration reserve market based on machine learning (Doctoral dissertation, Dissertation, Rheinisch-Westfälische Technische Hochschule Aachen, 2020)

-

Description of the balancing process and the balancing markets in Germany: https://www.regelleistung.net/Portals/1/downloads/modalitäten_rahmenvertraege/marktbeschreibung/Description of the balancing process and the balancing markets.pdf?ver=jxP7kkJgWsQjOyQ98AwSsA%3D%3D

-

MODO article on EFA blocks (Electricity Forward Agreements): https://modoenergy.com/research/efa-day-explainer-video

-

aFRR optimisation problem:

https://eepublicdownloads.blob.core.windows.net/public-cdn-container/clean-documents/Network codes documents/NC EB/2022/20220406_PICASSO_Public_Algorithm_description_v1.0.pdf