Unlocking Profit Potential in Wholesale Energy Markets: Virtual Cycling with Battery Storage

Entrix - 12/10/2023

In this article we explore the topic of what we at Entrix call “virtual cycling” in storage-backed electricity trading. We address the following questions:

- How does virtual cycling allow traders to capture price spreads within the same delivery period?

- Why is over 90% of Entrix’ wholesale trading volume not physically delivered, generating substantial revenue without degrading the battery?

- How our storage-backed trading strategy allows us to take advantage of volatility in prices for the same contract while minimizing financial risks?

Understanding the Basics: Wholesale Trading and Order Books

Wholesale trading (e.g., day-ahead and intraday) is the practice of trading energy for the next and within the same day, offering multiple opportunities as market conditions change. The continuous intraday market allows trading up to 5 minutes before the delivery period, making it ideal for adapting to renewable energy fluctuations. Many operators use it to adjust their open selling positions based on new renewable production forecasts.

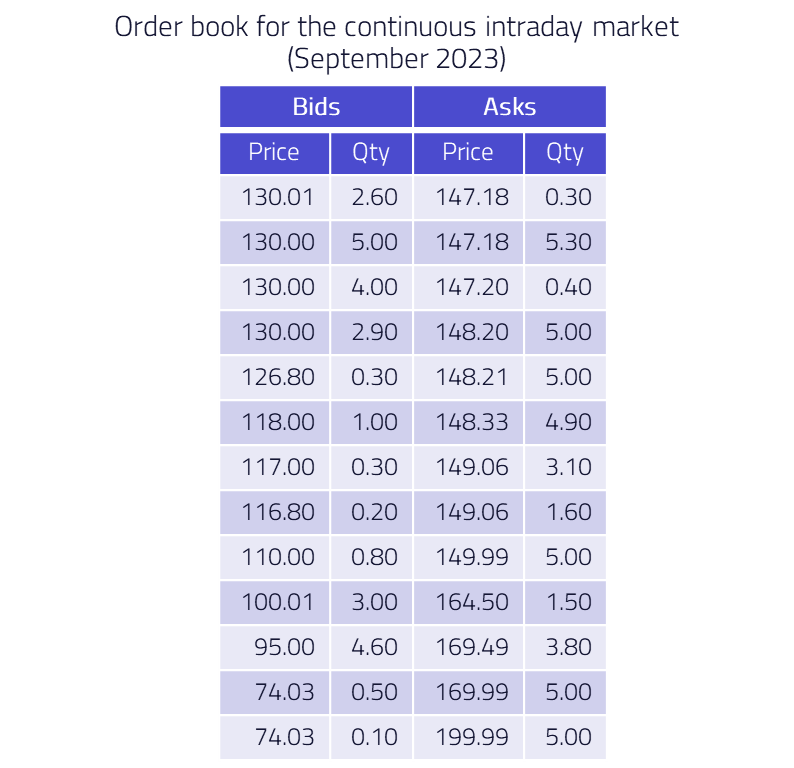

Within continuous intraday trading, order books serve as real-time records of buy and sell orders for electricity within specific delivery periods (e.g., 15-minute intervals in Germany). They reflect supply and demand dynamics. Market participants closely monitor these order books to make informed trading decisions. For successful virtual cycling, wholesale markets need to be highly liquid, characterized by high trading volumes and many participants.

In the following graphic you can see the order book for a specific delivery period in September 2023. "Bids" are buy orders, revealing the quantity (in MWh) and price (in €/MWh) buyers are willing to pay for electricity. Conversely, "asks" are sell orders, indicating the price and quantity at which sellers are willing to part with their electricity. The interaction between bids and asks in the order book establishes the market price, with trades occurring when a bid matches an ask at the same price level. The average price to which electricity was traded for a certain delivery period is known as volume-weighted average price (in short: VWAP).

Understanding Virtual Cycling

Virtual cycling, also known as virtual trading or proprietary trading, involves buying and selling energy for the same delivery period, with a focus on leveraging real-time market dynamics to optimize trading decisions. This approach aims to identify opportunities and execute trades continually, ultimately significantly increasing revenue.

The Role of Battery Storage and Sophisticated Trading Algorithms

Battery storage systems serve as a critical component in executing virtual trading strategies, functioning as a reliable physical backup. This approach offers more flexibility when trading specific contracts, as it allows optimisers to maintain open positions (charge or discharge) without the obligation to close them before the delivery period, provided that the physical battery conditions and warranty allow it. In doing so, it minimizes the risk of market behavior deviating from the algorithms' expectations.

Meanwhile, the backbone of virtual cycling lies in sophisticated trading algorithms. Continuously monitoring and analyzing the order book, these algorithms adapt to dynamic market conditions by executing new trades and closing existing ones, ensuring precise and timely responses. This adaptability is particularly crucial in markets characterized by a substantial presence of renewable energy, where supply patterns can undergo significant fluctuations, and trading volumes in wholesale markets are notably high.

Real-Time Optimization

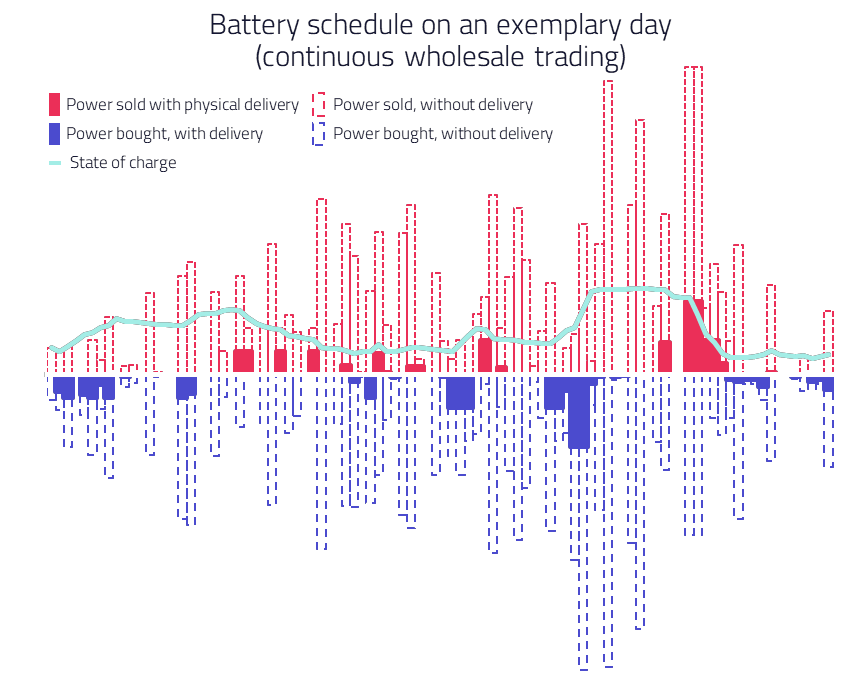

Real-time optimization is central to the success of virtual cycling. Given the variable nature of renewable energy sources, supply and demand dynamics can shift rapidly. Trading algorithms respond to these changes promptly, facilitating well-informed and profitable decisions. Entrix executes a significant number of trades daily, approximately 200 trades per day per installed battery MW. The graphic below shows an exemplary day with real trades executed by Entrix. One can see that the algorithm becomes more active the closer we move to the delivery period and that prices evolve a lot - leading to Entrix selling for multiples of the average price for some specific delivery periods (e.g. at 10 am).

Maximizing Profit and Minimising Risks

The primary objective of virtual cycling is profit maximization. By exploiting price differentials within the same delivery period, asset owners can achieve substantial gains. This approach essentially enables the benefits of prop trading without the associated risks.

Entrix' wholesale algorithms meticulously account for market volatility and battery degradation costs in every trade. In the standard setting, Entrix always stays within the physical boundaries of the battery, meaning our algorithms are never forced to close a position which could then trigger costs (e.g. for a 10 MW battery, we would not place a 20 MW order). Depending on the risk appetite of our customers, we can adjust these parameters.

The Significance of a Fully Automated Trading System and Ongoing, Direct Communication with the Asset

In the context of virtual cycling with battery storage, precision and timely actions are paramount. To fully exploit this strategy, having a completely automated trading system is a must. Entrix' system allows for quick decision-making in real-time, enabling our algorithms to promptly respond to changes in the market.

Furthermore, maintaining constant and direct communication with the asset, the battery storage system, is crucial. This direct link ensures that the system works seamlessly and can execute trades smoothly, aligning perfectly with the algorithms' decisions. Any delay or interruption in communication could lead to missed opportunities, less effective execution or high imbalance costs. This underscores the vital role of this direct connection in optimizing virtual cycling strategies.

Given Entrix’ speedy infrastructure, we trade over 15 times more virtually than physically. In the graphic below you can see what the outcome looks like on an exemplary day.

Conclusion: A Strategic Advantage

Virtual cycling with battery storage is reshaping energy trading, adapting to evolving market conditions, and capturing price spreads within the same delivery period, offering a strategic advantage.

Questions? Contact Us

Raphael Muñoz - Senior Sales Manager

E-mail: raphael.munoz@entrixenergy.com